Report 1/2024

State of Commerce Advertising

The industry index for decision-makers in performance marketing, commerce content, partner marketing, and affiliate marketing.

Get resultsStrong partnerships

drive success in

Commerce Advertising

Dear reader,

The results for 2023 show a high level of satisfaction among survey respondents, particularly with Q4, the quarter with the highest revenue. This prevailing positive sentiment is reassuring – in many other industries, the tone is more negative – and it shapes an optimistic outlook for 2024.

Good prospects for Commerce Advertising: The share of total revenue generated by Commerce Advertising has grown. And almost 60 percent of respondents plan to increase their budget for Commerce Advertising in 2024.

Commerce Advertising is built on cooperating with the right partners and successfully managing partner relationships. This crucial aspect takes centre stage in our industry report. One of our objectives has been to evaluate the satisfaction of industry experts with their current partnerships and expectations for their partners.

For the first time, four top experts have contributed their expertise by adding guest questions. In this report, you can discover which topics are relevant for Kate Knight (CJ), Daniel Baptiste-Pilkington (PayPal Shopping), Paul Stewart (Awin), and Felix Lander (Business Insider). We are particularly thrilled that this survey had the highest number of participants to date. The diverse array of responses serves as a valuable source of inspiration for the year 2024.

I hope you enjoy the report and gain profitable insights!

Best wishes,

The results for 2023 show a high level of satisfaction among survey respondents, particularly with Q4, the quarter with the highest revenue. This prevailing positive sentiment is reassuring – in many other industries, the tone is more negative – and it shapes an optimistic outlook for 2024.

Good prospects for Commerce Advertising: The share of total revenue generated by Commerce Advertising has grown. And almost 60 percent of respondents plan to increase their budget for Commerce Advertising in 2024.

Commerce Advertising is built on cooperating with the right partners and successfully managing partner relationships. This crucial aspect takes centre stage in our industry report. One of our objectives has been to evaluate the satisfaction of industry experts with their current partnerships and expectations for their partners.

For the first time, four top experts have contributed their expertise by adding guest questions. In this report, you can discover which topics are relevant for Kate Knight (CJ), Daniel Baptiste-Pilkington (PayPal Shopping), Paul Stewart (Awin), and Felix Lander (Business Insider). We are particularly thrilled that this survey had the highest number of participants to date. The diverse array of responses serves as a valuable source of inspiration for the year 2024.

I hope you enjoy the report and gain profitable insights!

Best wishes,

Felix Witte

General Manager / SVP Publishers & Advertisers

What is Commerce Advertising?

Commerce Advertising is an approach to online advertising that combines the strengths of performance marketing, commerce content, and affiliate marketing: Contextual advertising along the customer journey helps users make better purchase decisions, opens up diversified monetization channels for publishers, and enables advertisers to maximize performance by accessing purchase-critical touchpoints.

About the study

Between December 6 and 19, 2023, 73 industry experts took part in the survey for the industry index “State of Commerce Advertising / 1st edition of 2024”. Close to 50% of participants consisted of publishers, while advertisers made up almost 18%, and networks or technology providers constituted around 10%. Agencies and other company types collectively comprised slightly over 23%.

Key Takeaways

1.

Commerce Advertising stands for successful partner marketing.

The power of strong partnerships: 62% of respondents are satisfied or very satisfied with their partnerships in Commerce Advertising. Both advertisers and publishers see partner marketing primarily as an opportunity to establish and expand cooperation and thus achieve joint growth.

2.

Commerce Advertising drives revenue.

Commerce Advertising’s share of total revenue continued to grow last year. 74% of respondents now generate at least 15% of their revenue with Commerce Advertising, a substantial increase from 58% in the previous year. In the face of an economically challenging 2023, Commerce Advertising is proving to be resilient.

3.

Commerce Advertising demonstrates agility.

Changes in cookie management, the introduction of AI in all areas of marketing, the demand for more transparency: The industry grapples with multifaceted challenges. Despite this, the industry reports of the last two years have shown that Commerce Advertising can adapt quickly. The past year, specifically, witnessed a commendable level of satisfaction among industry players, with 53% expressing contentment or high satisfaction. Dissatisfaction levels were relatively low, with only 12% feeling dissatisfied or very dissatisfied.

4.

Commerce Advertising shows clear industry dynamics & trends.

The industry is currently shaped by three dominant trends — Artificial Intelligence (AI) leading at 59%, Influencer Advertising at 48%, and Measuring (Dynamic) Attribution at 27%. Most participants do not yet have clear AI strategies but see it improving their operations. Influencer advertising is progressively becoming an integral part of advertisers’ Commerce Advertising strategies. Simultaneously, Measuring (Dynamic) Attribution remains relevant as the industry aims to ensure fair partner compensation. Another noteworthy trend is the increasing focus on Video-based advertisement, with 49% of participants planning to boost investments.

State of Commerce Advertising

Overall State of the Industry

Economically, 2023 was a difficult year. Price increases and economic stagnation had a negative impact on consumer spending. How are these conditions reflected in the industry? And what implications do they hold on the expectations for 2024?

How satisfied are you with your commercial performance in Q4/2023?

A successful end to the year: 64.3 % of respondents are satisfied or even very satisfied with the last quarter, and only 6.9 % are dissatisfied or very dissatisfied.

Very satisfied

16.4%

Satisfied

47.9 %

Neutral

28.8 %

Dissatisfied

5.5%

Very dissatisfied

1.4%

How satisfied are you with your commercial performance in the entire year 2023?

53.4 % of respondents are satisfied or even very satisfied with the year 2023; 34.2 % view it as neutral. Despite the economic downturn, only 12.3 % are dissatisfied with 2023.

Very satisfied

8.2%

Satisfied

45.2%

Neutral

34.2%

Dissatisfied

12.3%

Very dissatisfied

0.0%

What is your outlook on your commercial performance in 2024?

The overwhelming majority (74 %) of respondents are optimistic or very optimistic about 2024, while only 8.2 % are pessimistic. This result is significantly more positive than in the previous year: At the end of 2022, the general sentiment was more reserved with only 57.5 % feeling optimistic or very optimistic about 2023, and 12.7 % expressing pessimism or strong pessimism.

Very optimistic

11.0%

1/2024

14.9%

1/2023

Optimistic

63.0%

1/2024

42.6%

1/2023

Neutral

17.8%

1/2024

29.8%

1/2023

Pessimistic

8.2%

1/2024

10.6%

1/2023

Very pessimistic

0.0%

1/2024

2.1%

1/2023

What do you see as the biggest opportunity for revenue growth in the upcoming year?*

* Up to 3 answers possible

49.3 % of respondents consider “increasing investment in partnerships” the top revenue driver in 2024. Diversifying the partner base and expanding into other markets are also seen as big opportunities (31.5 % each).

Kate Knight

EMEA Group Director / Publisher Development, CJ

Download the Commerce Advertising Report 1/2024 now!

Get all results in a comprehensive format here.

Download nowState of Commerce Advertising

Market Review

What role does Commerce Advertising currently play in companies? What strengths does Commerce Advertising offer, compared to other forms of advertising? And, above all: Are budget adjustments planned for Commerce Advertising in 2024?

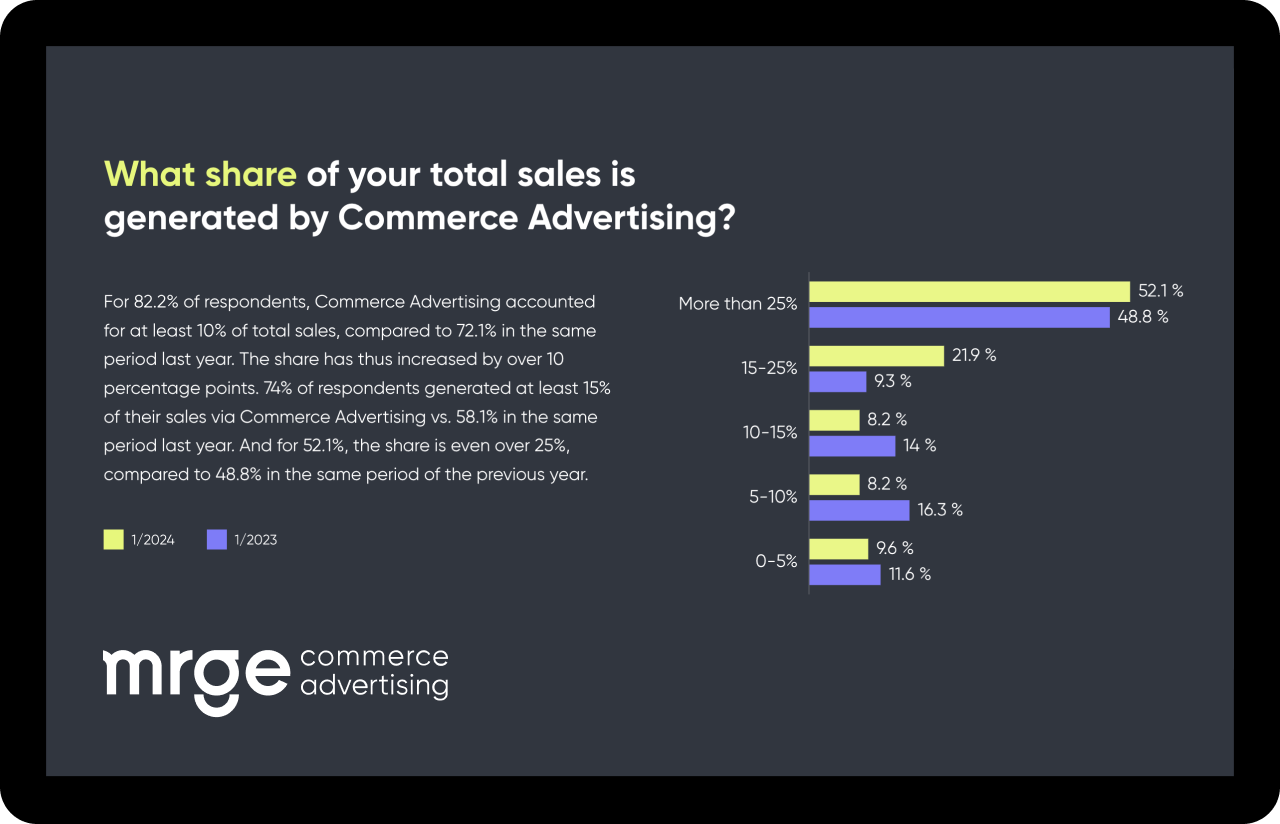

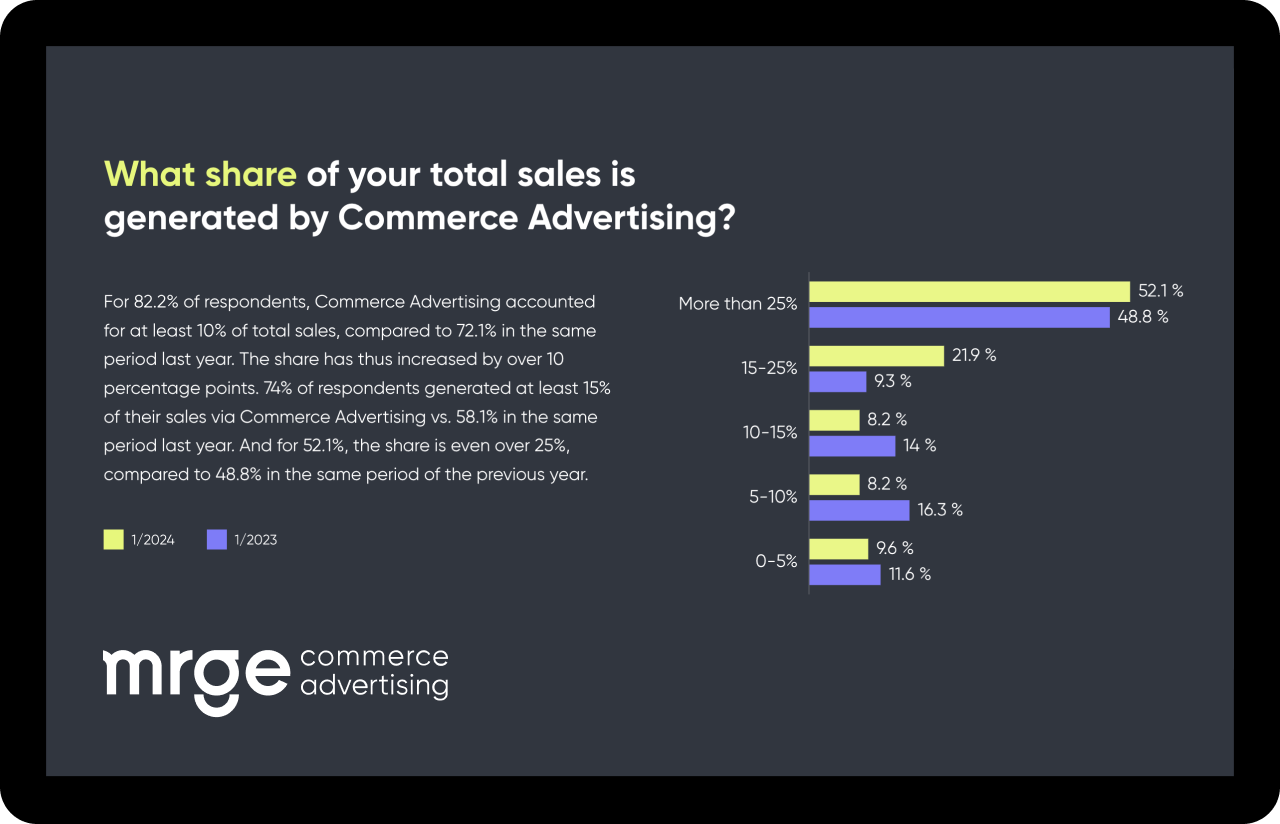

What share of your total sales is generated by Commerce Advertising?

For 82.2% of respondents, Commerce Advertising accounted for at least 10% of total sales, compared to 72.1% in the same period last year. The share has thus increased by over 10 percentage points. 74% of respondents generated at least 15% of their sales via Commerce Advertising vs. 58.1% in the same period last year. And for 52.1%, the share is even over 25%, compared to 48.8% in the same period of the previous year.

1/2024

1/2023

Are you planning to adjust your budget for Commerce Advertising in 2024 compared to 2023?

A notable 57.5 % of respondents express an intention to expand their budget in 2024 and plan to spend more on Commerce Advertising. In contrast, only 2.7 % indicate a desire to decrease their budget.

Do you intend to increase investment in video-based commerce campaigns next year?

As respondents intend to increase their investment in Commerce Advertising for 2024, the question arises: Will video ad campaigns also benefit from this?

Paul Steward

Group Strategic Partnerships Director, Awin

What is the specific role of Commerce Advertising for your sales compared to other digital advertising forms?

Numerous participants provided comprehensive responses to the open-ended question, and a consistent theme emerges: Commerce Advertising consistently delivers high-quality traffic, boosts conversion rates, and ultimately contributes to additional revenue.

What publisher types generated the most sales for you in the last quarter?*

* Up to 3 answers possible

The top 3 revenue drivers in Q4/2023, by publisher type: cashback sites/extensions (43.8 %), coupon pages (38.4 %) and Buy-Now-Pay-Later (BNPL) providers (31.5 %).

What is your favorite billing model?

Overall, the preferred billing models are CPO/CPA at 57.5 % and CPC at 32.9 %.

Cost per order (CPO/CPA)

Cost per click (CPC)

Cost per lead (CPL)

Tenancy placements

Other

State of Commerce Advertising

Trends & Challenges

What trends will determine the future of Commerce Advertising? What are the biggest challenges? And what valuable insights can we gather from responses to the guest questions posed by our top experts?

What are the top industry trends in Commerce Advertising right now?*

* Up to 3 answers possible

“Artificial intelligence and/or machine learning” remains the top trend, cited by 58.9 % of respondents. “Influencer advertising” is in second place (47.9 %), and "Measuring (dynamic) attribution" came in third (27.4 %).

How do you anticipate adjusting your affiliate marketing strategy in response to the introduction of ChatGPT and Google Bard, considering the revamped search experience that diminishes the need to visit publisher websites?

ChatGPT and Google Bard now play an important role in marketing. But what does this mean for the strategic positioning of affiliate marketing?

Felix Lander

CRO, Business Insider DACH

What is the biggest challenge in Commerce Advertising you see for the next year?

In response to the open question, data privacy, Google updates, and cookies were consistently identified as the predominant challenges.

Do you think basket freezing is a fair practice for publishers and do you think it takes into consideration how consumers shop?

Survey participants hold varying perspectives on the opportunities and challenges presented by different forms of Commerce Advertising. One approach to attribution is basket freezing. Basket freezing allows advertisers to ignore partner interactions that were generated after the check-out process has started. How does the "basket freeze" method fit into the attribution discourse?

Daniel Baptiste-Pilkington

Director, PayPal Shopping - International

State of Commerce Advertising

The Relevance of Partnerships

In Commerce Advertising, publishers, networks, and advertisers collaborate with the shared objective of boosting and scaling sales revenues. How satisfied are industry players with their partnerships? What do they expect from their partners in 2024?

How satisfied are you with your partnerships in Commerce Advertising?

61.7 % of respondents are satisfied, or even very satisfied, with their partnerships in Commerce Advertising. Only 5.5 % are dissatisfied.

Very satisfied

11.0%

Satisfied

50.7 %

Neutral

32.8 %

Dissatisfied

5.5%

Very dissatisfied

0.0%

As we look ahead to 2024: What are your expectations from your Commerce Advertising partners?

For respondents, expanding current partnerships, aligning common goals, and robust reporting stand out as decisive factors shaping their perspectives on partnerships in 2024.

Join the Panel

For its “State of Commerce Advertising” index, mrge regularly surveys the industry’s top experts and decision makers. Become part of this expert panel and actively shape the future of the industry! Register today, join our next panel survey in June 2024, and receive the results before everyone else:

Join now

Join the Panel!

Download the Commerce Advertising Report 1/2024 now!

Are you ready to grow?

We are.